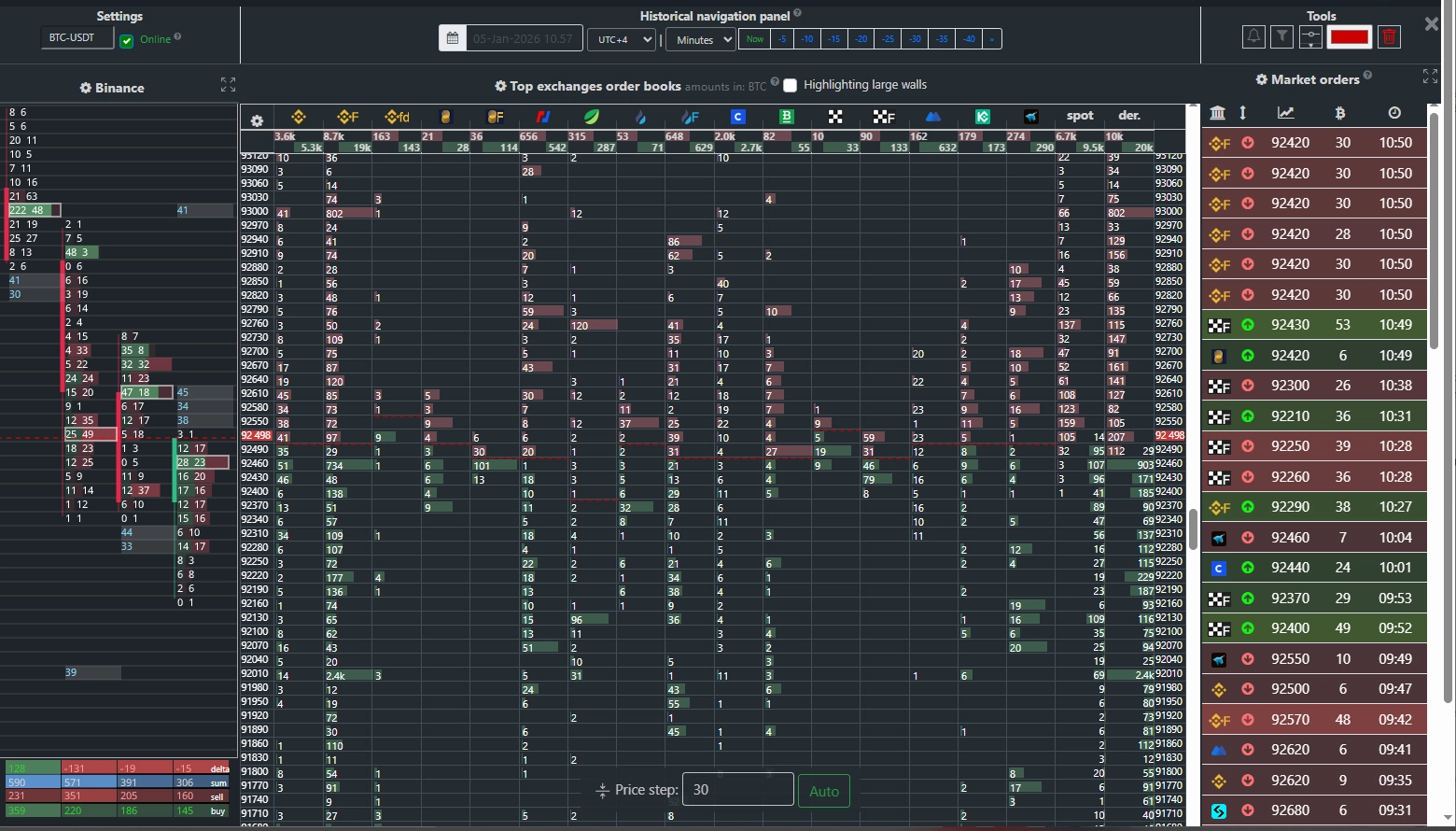

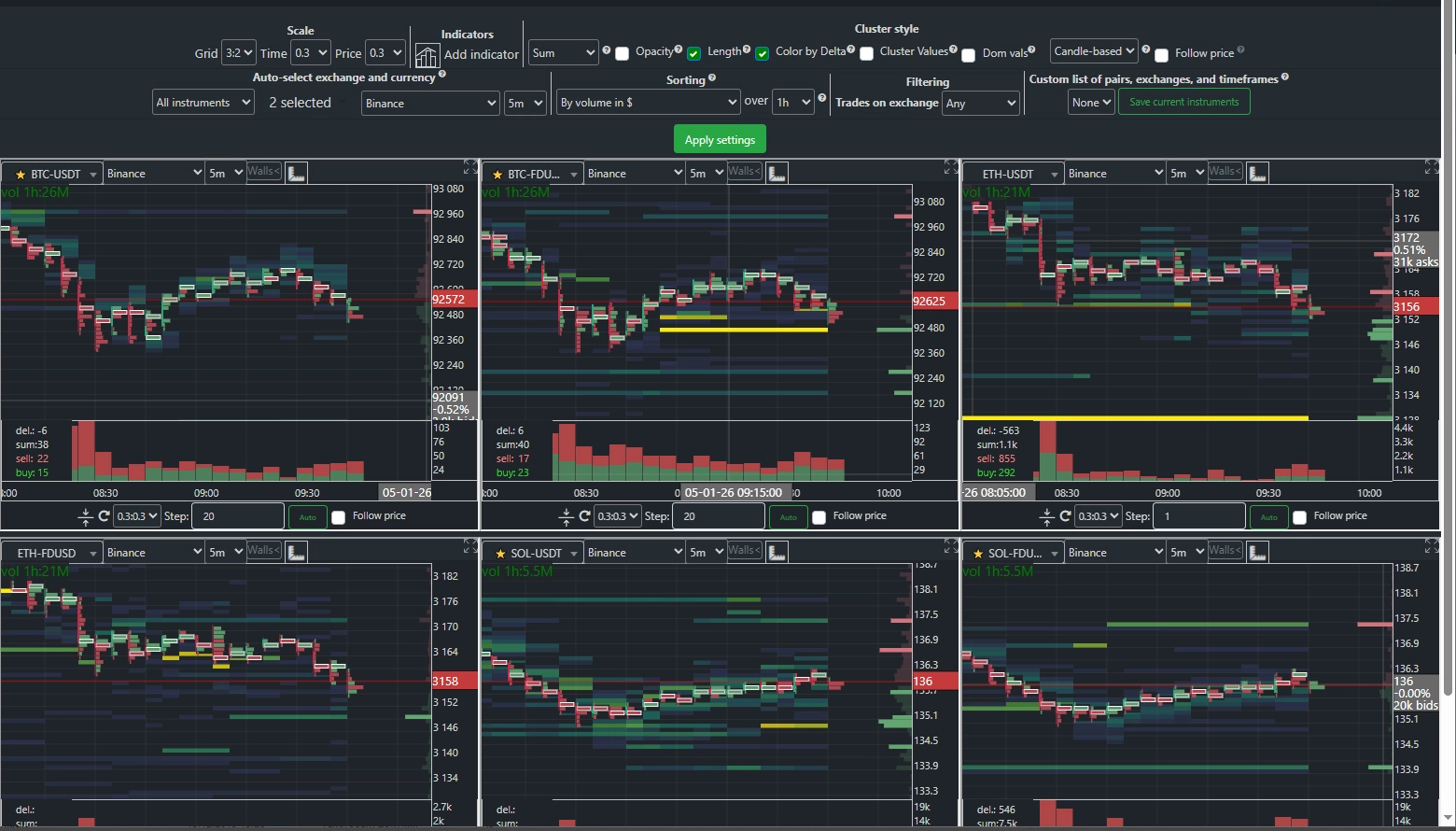

Bitcoin and other cryptocurrency order books from all major exchanges on a single screen.

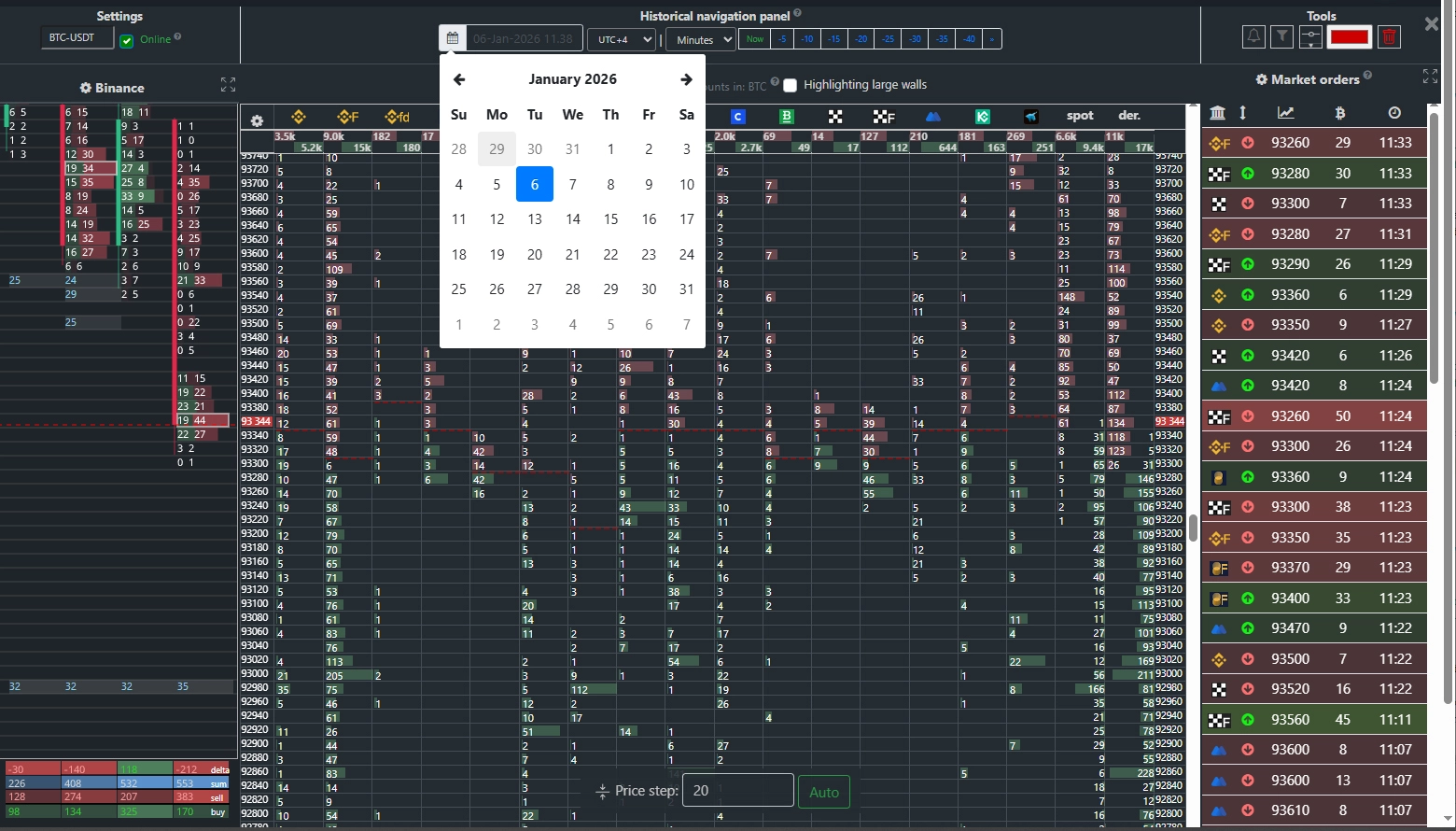

Monitoring order books is one of the most critical components of a successful Bitcoin and cryptocurrency trading strategy. The Cluster Btc analytics system enables you to track the movement of walls in the order books of all major exchanges simultaneously. Within seconds, you can identify all significant zones of interest for large market participants across every exchange.

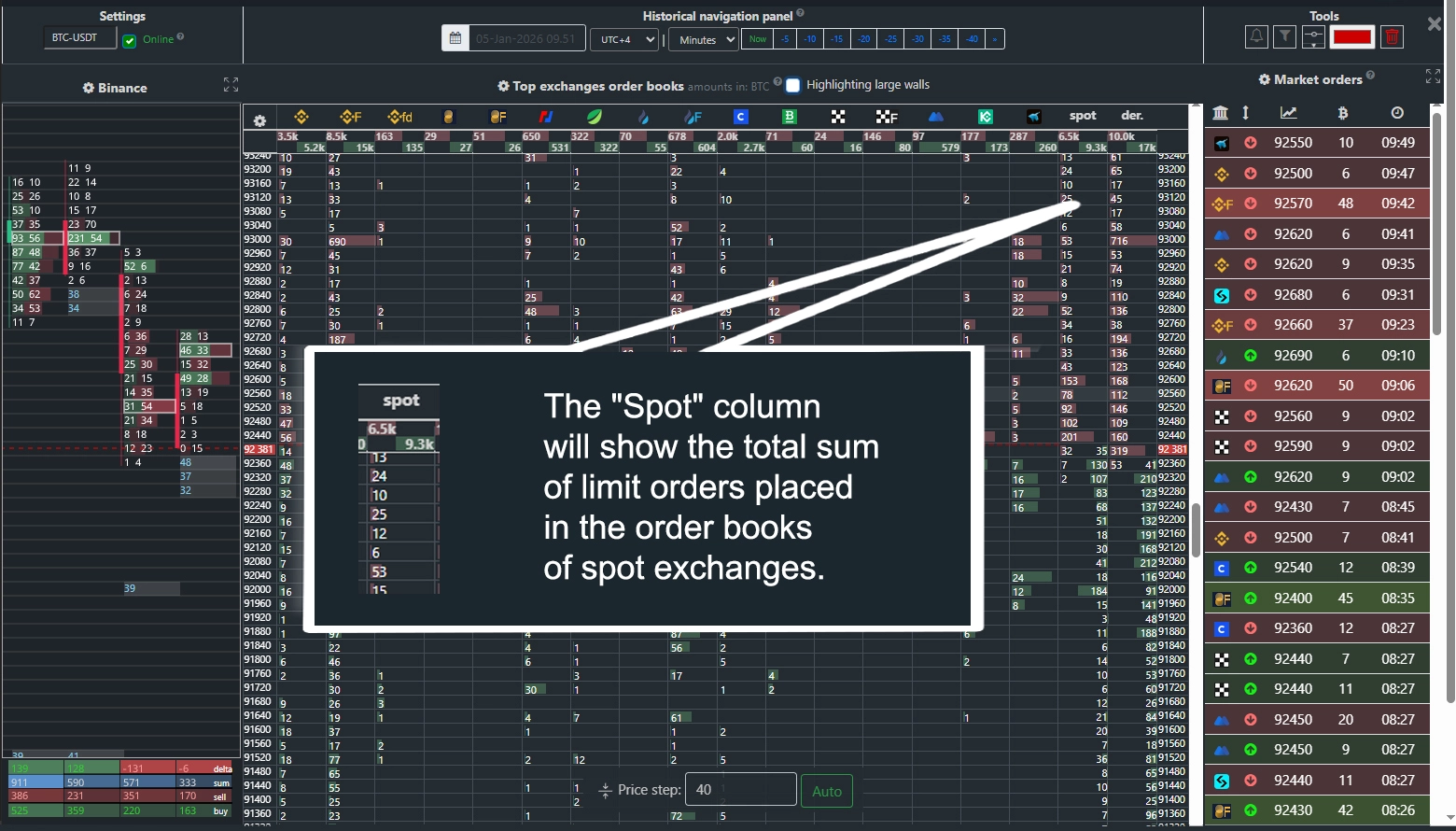

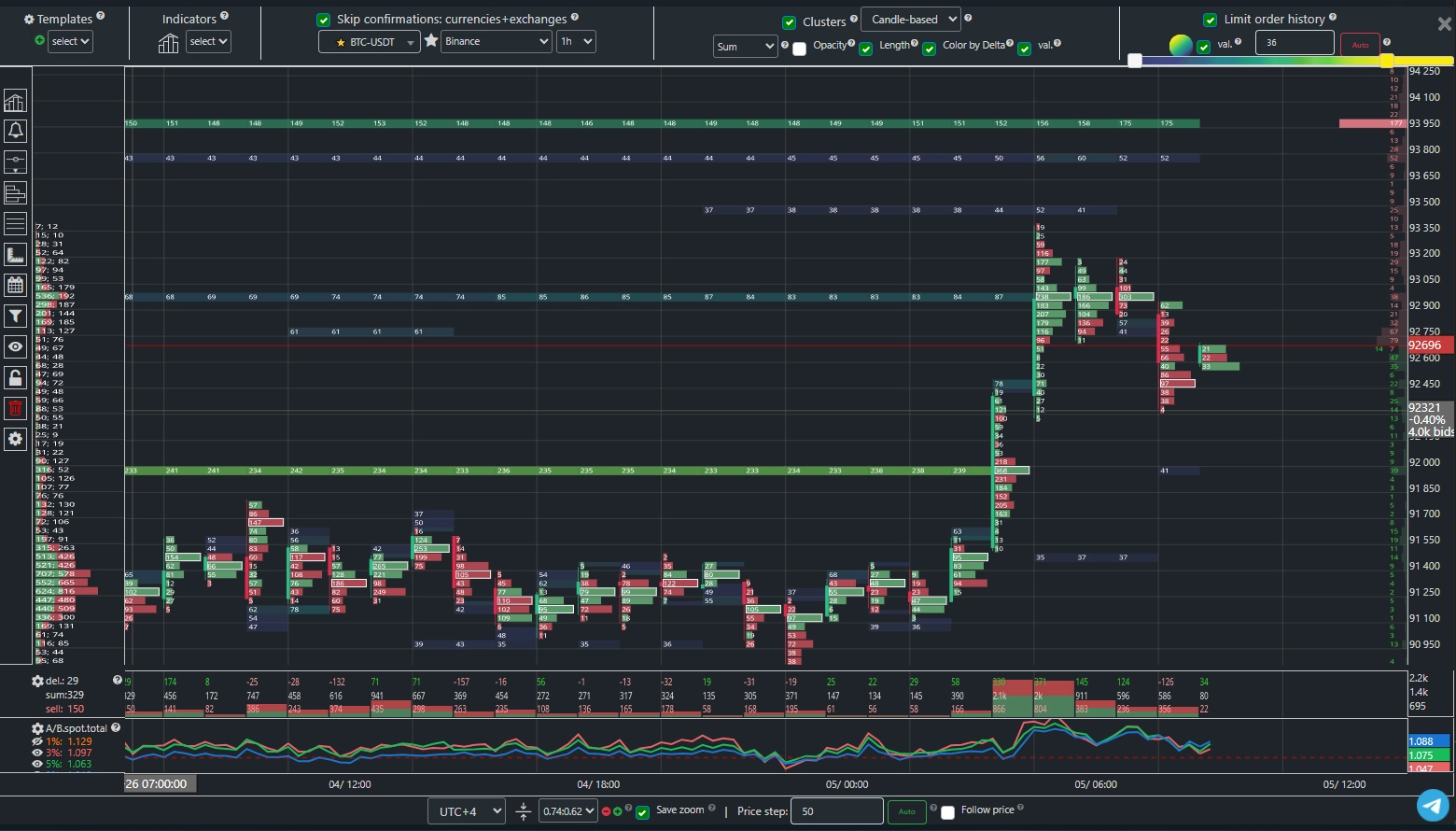

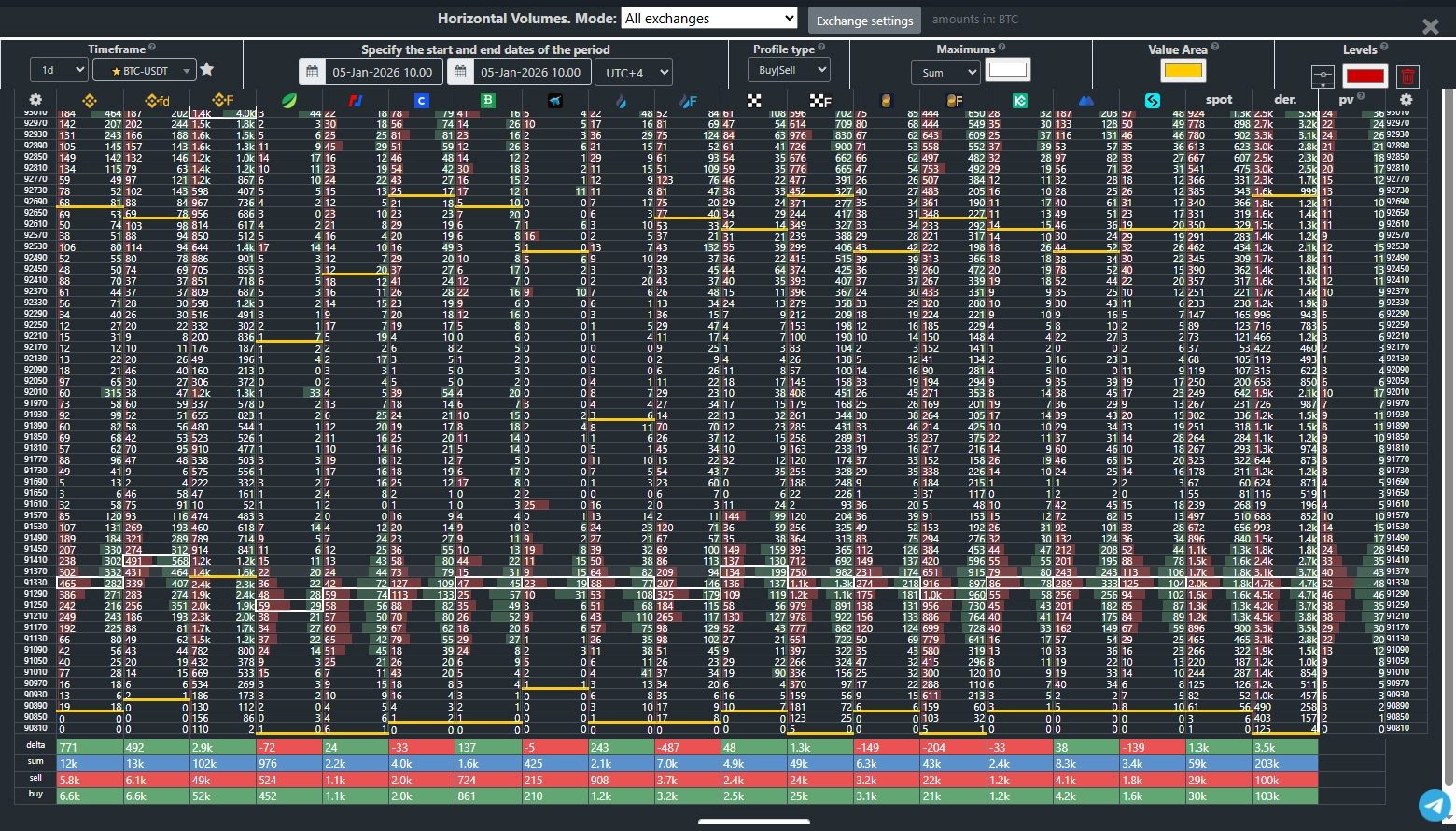

The “Spot” column displays the total volume of limit orders placed in the order books of spot exchanges: Binance (USDT, TUSD, FDUSD, and BUSD), Coinbase, Bitfinex, Bitstamp, Htx, Okx, Bybit, Mexc, KuCoin, Bitget. “Der.” shows the aggregated limit order volume from derivatives platforms: Binance Futures, Bitmex, Huobi Futures, Okx Futures, Bybit Futures.

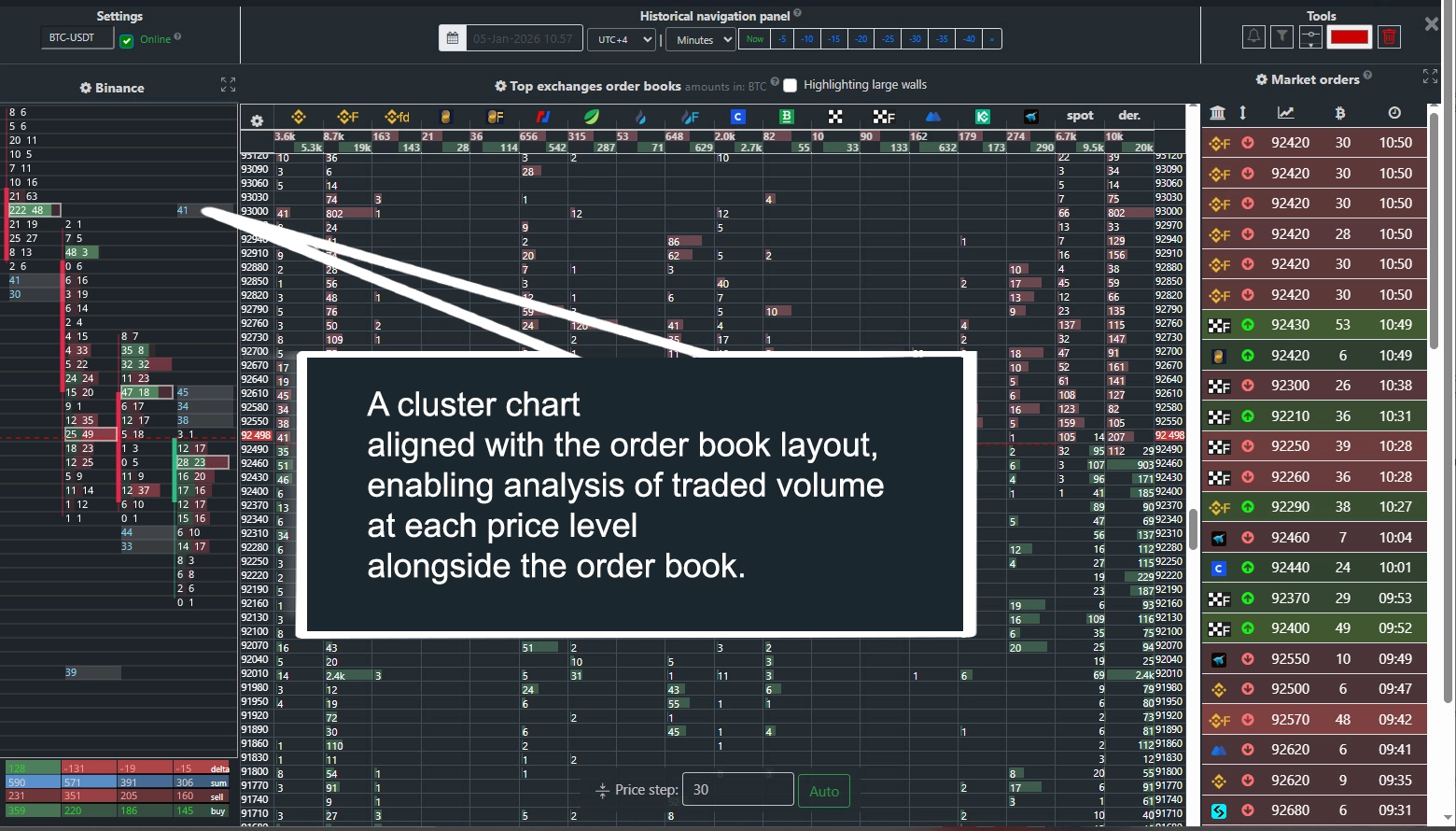

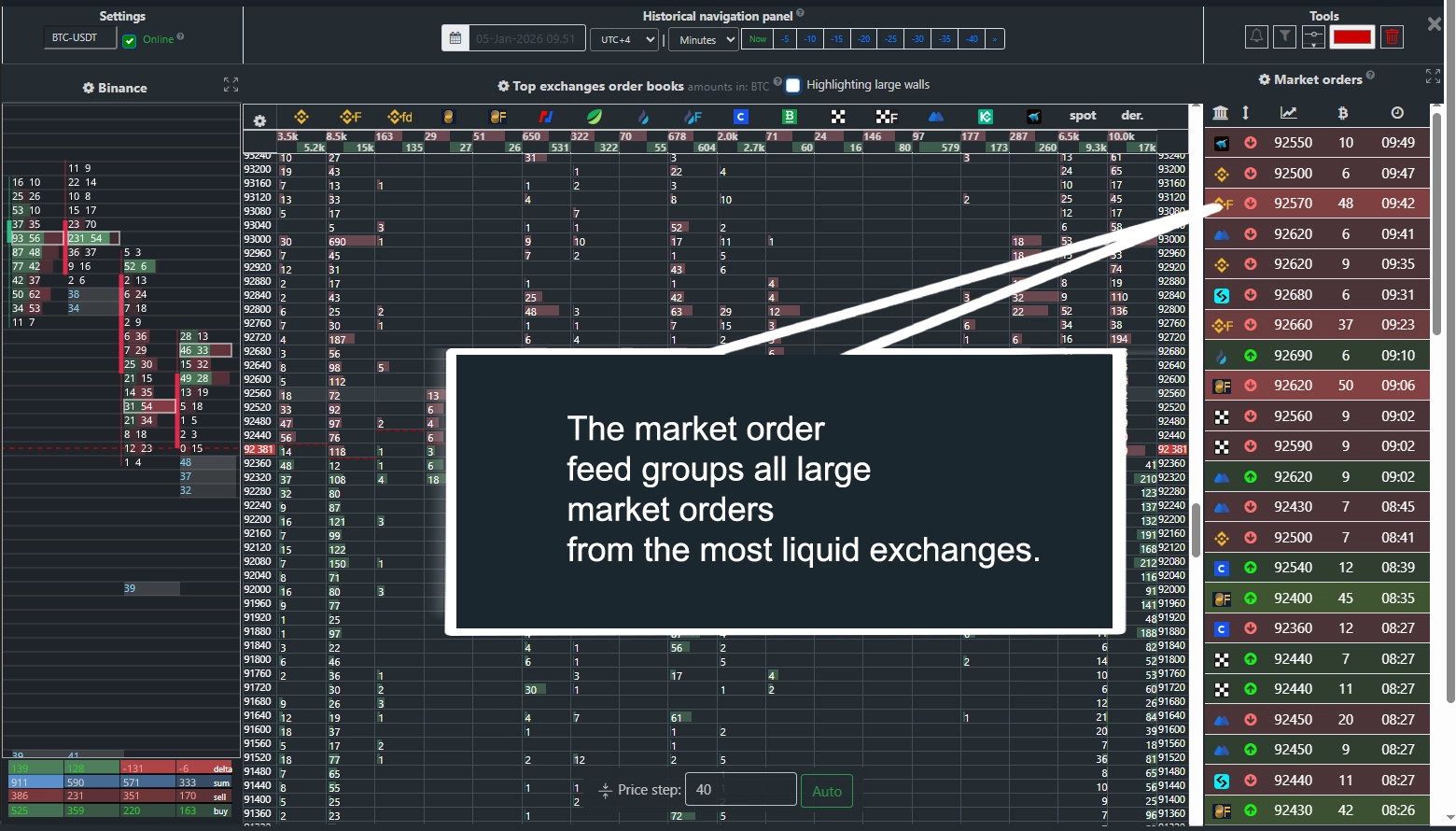

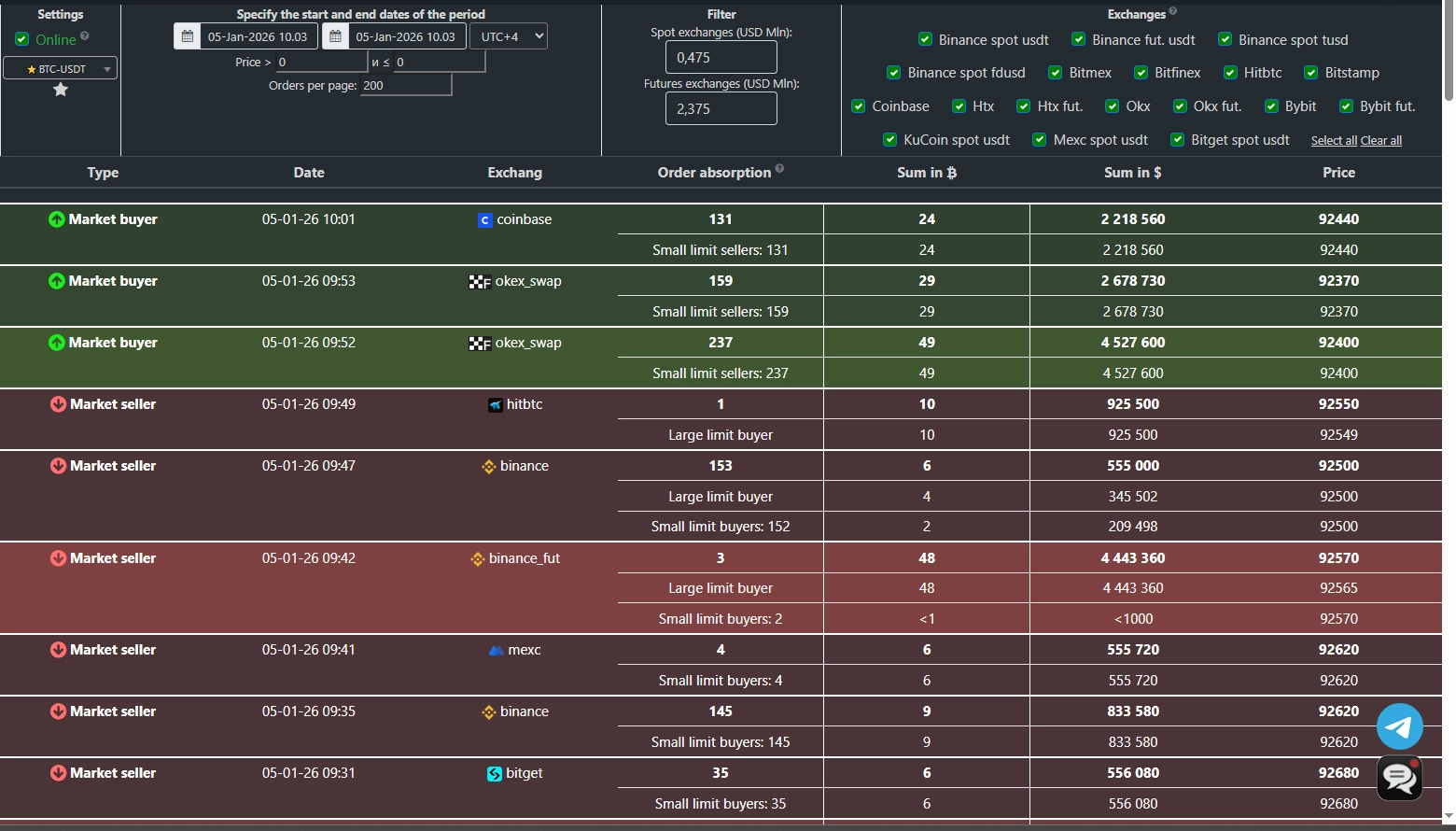

Bitcoin order books are positioned opposite each other and integrated directly with the cluster chart for the most convenient analysis. The cluster chart also visualizes the historical movement of large walls in the Bitcoin exchange order book. Intuitive navigation through history makes it easy to monitor the activity of major players. The large orders panel displays all significant market trades while filtering out insignificant, low-volume noise orders.

Want to learn more?

Key features in 1.5 minutes

Explore the key points.

Complete guide in 18 minutes

Get comprehensive information.

Discover all analysis modes

7 days

1 Month

12.95

- Basic plan

- Save 0 $

- All features available.

3 Months -17%

38.85

32.26

- Only 10.75 $ / month

- Save 6.61 $

- All features available.

1 Year -34%

155.4

102.60

- Only 8.55 $ / month

- Save 52.85 $

- All features available.