Boost Your Profit

An analytical system for conducting cluster analysis, tracking wall movements in order books, and monitoring large market players orders for Bitcoin, Ethereum, and 160 other cryptocurrencies.

Try it for free right now

Features of ClusterBTC

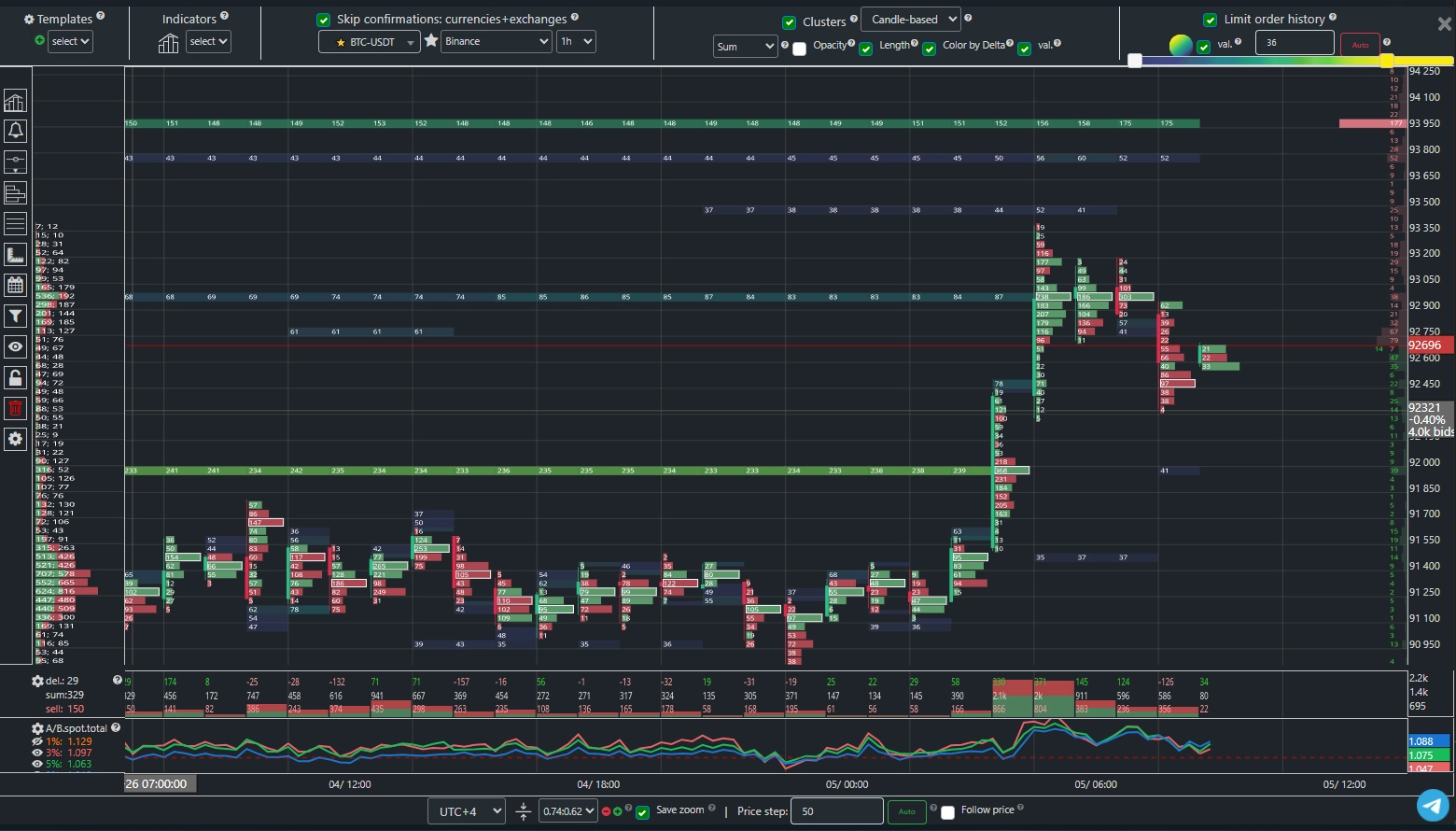

Bitcoin Cluster Chart

The cluster chart displays the volume of buys and sells at each price level within a specific candle. Access to the most liquid cryptocurrency exchanges, as well as an overall chart for the entire spot market, with the ability to add the history of large limit order movements from order books to the chart. By analyzing the movement of limit order walls, as well as the volume of buys and sells near key levels, one can accurately identify strong support and resistance zones. A wide range of analytical tools is available, including Bid-Ask sum and ratio indicators, cumulative delta, and aggregated volume profiles with market-wide data.

Charts: «Sum of Spot Exchanges» and «Sum of Derivatives»

Sums up all limit and market orders, creating a unified cluster chart from the most liquid spot platforms. Binance (usdt, tusd, fdusd), Coinbase, Bitfinex, Bitstamp, Htx, Okx, Bybit, KuCoin, Mexc, Bitget.

You have access to a variety of tools, including indicators for analyzing the dominance of buyers and sellers, such as «Delta» and the cumulative «Cumulative Delta», across the entire spot market, all on a single page. A similar mode is also available for derivative exchanges, including data from the largest futures platforms: Binance futures, Bitmex, Huobi futures, Okx fut., Bybit futures.

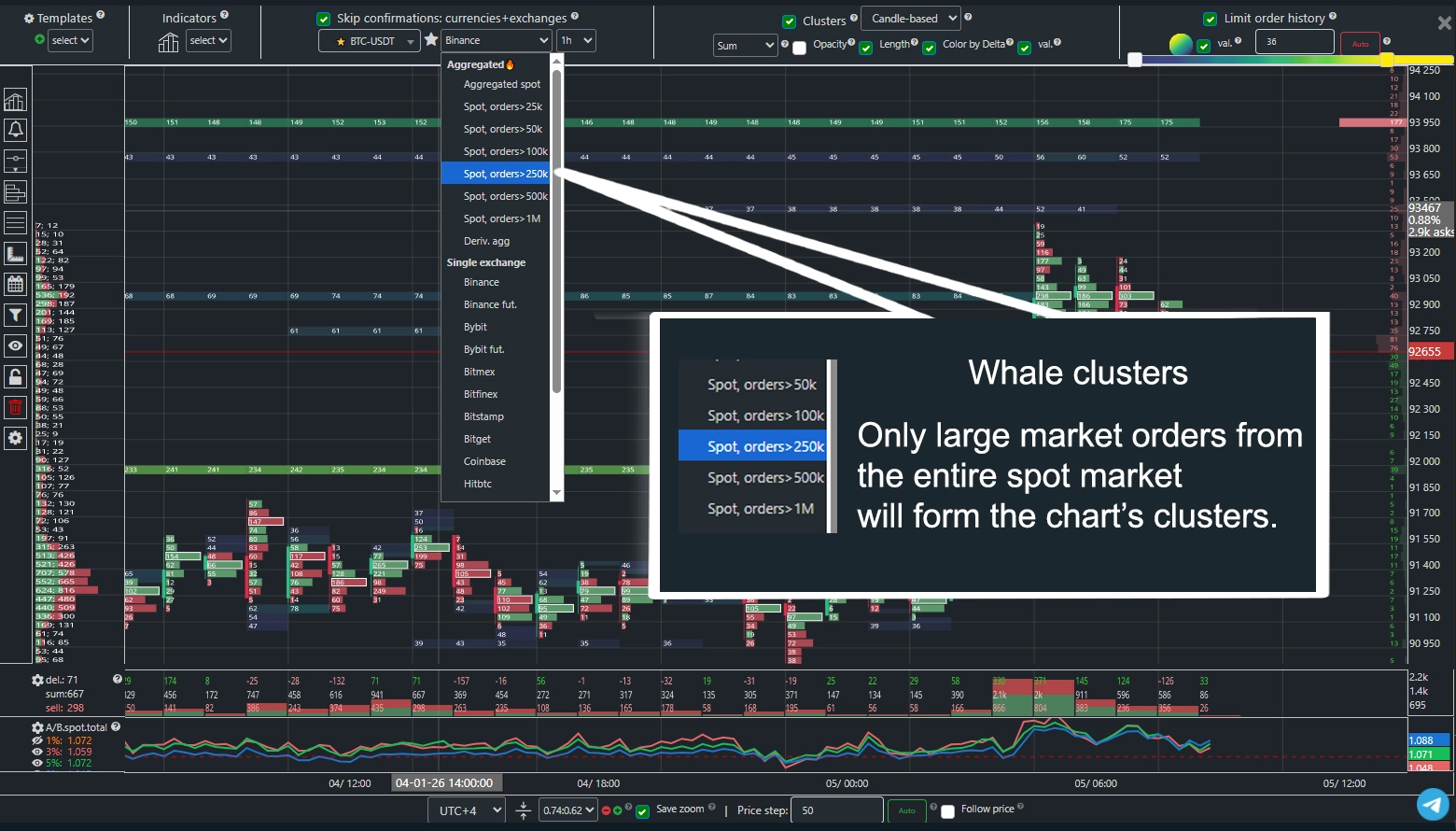

Cluster chart for major players

The cluster chart is built based on large market orders, excluding all minor trades. Data is aggregated from all leading spot exchanges, enabling the creation of a comprehensive consolidated chart of major players activity. This approach provides a more accurate representation of capital movement and market trends driven by significant market participants.

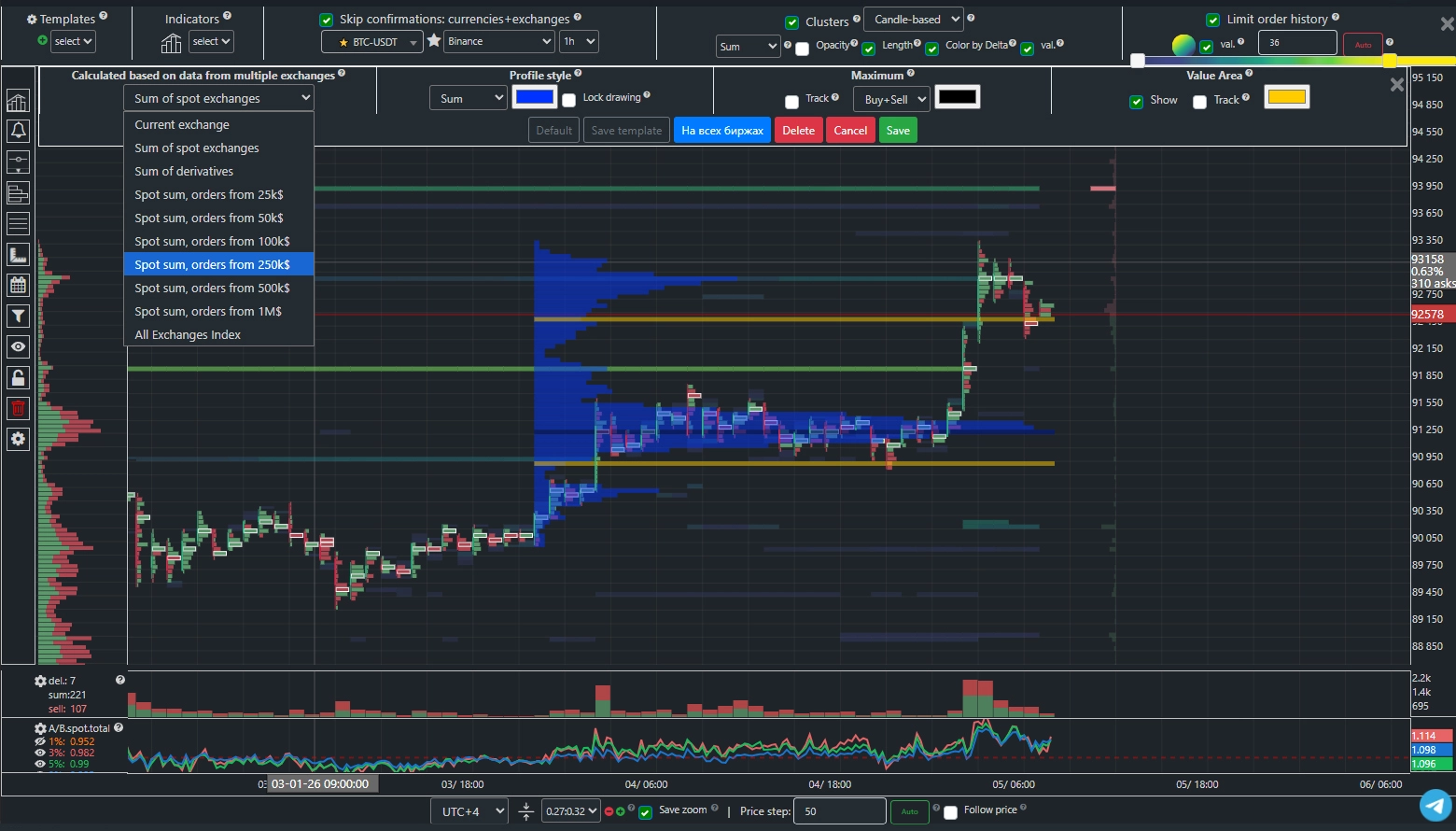

Volume profile, whales delta

Based on the data from the major players cluster chart, you can build a volume profile and calculate various indicators, such as volumes, delta, and cumulative delta. These powerful analytical tools provide deeper insights into the behavior of major players and their impact on the market. You can choose from several filtering thresholds for small orders, ranging from 25k$ to 1M$

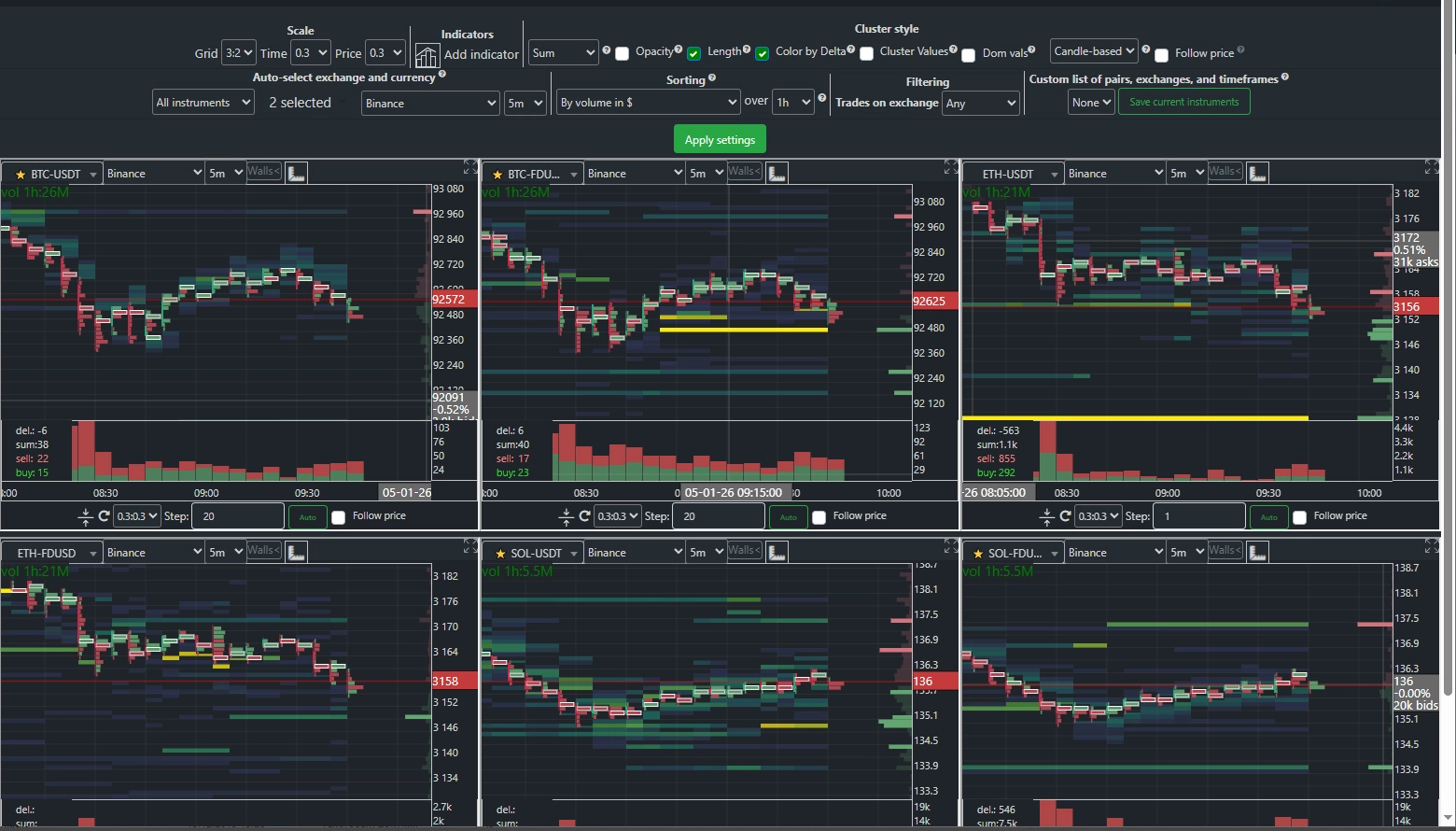

Cryptocurrency screener

Perform quick analysis of a large number of instruments, timeframes, and exchanges on a single screen. For user convenience, various asset sorting methods are provided, allowing you to quickly find the most promising instruments. You have access to a wide range of filters and indicators, as well as different sorting modes, including filtering by trading volume, price movement dynamics, and changes in the balance of buy and sell orders at different market depth levels. The system allows the use of up to 9 blocks on a single page, ensuring maximum analysis efficiency.

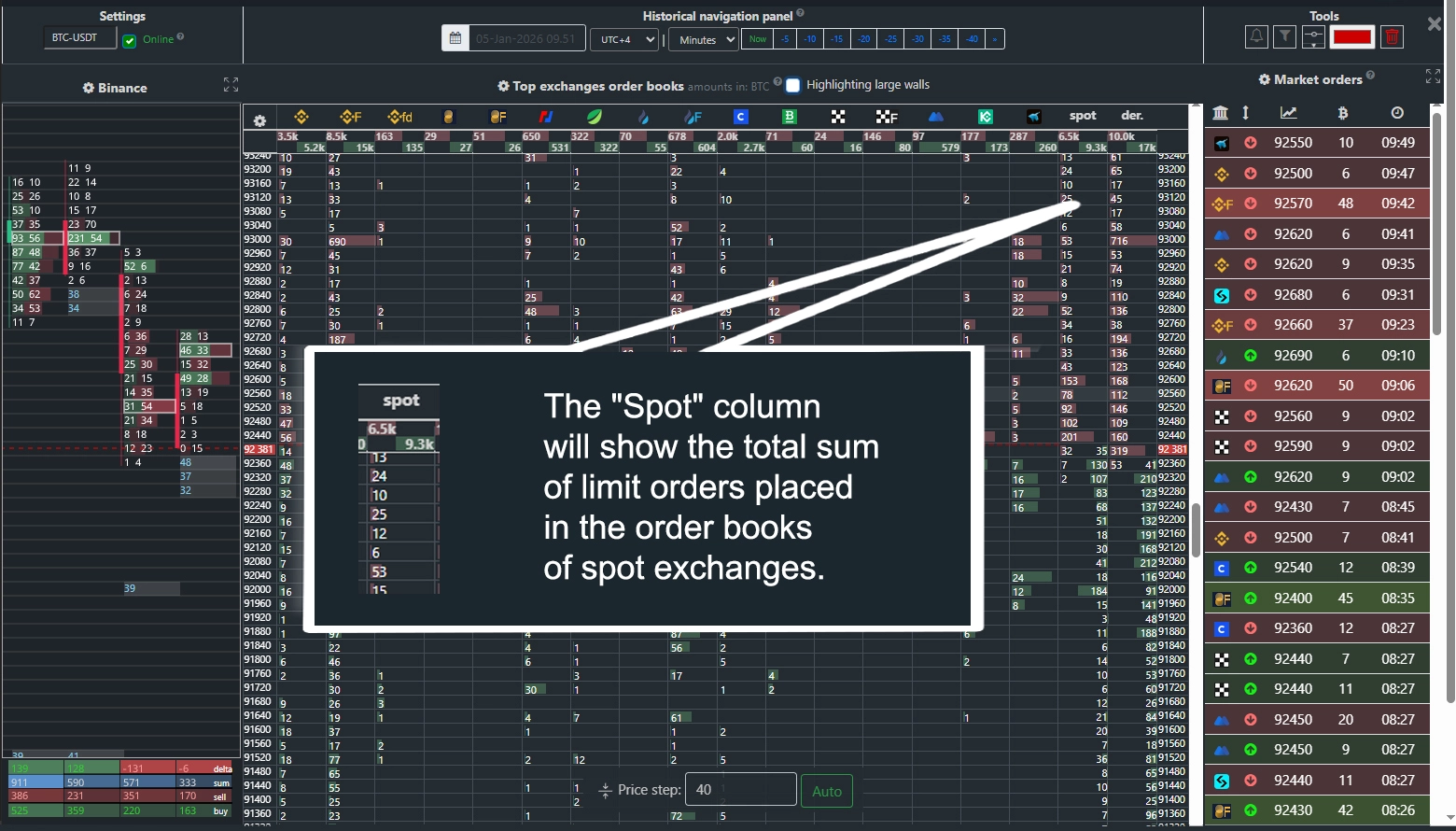

Bitcoin order books across all exchanges

The convenient arrangement of exchange order books side by side allows you to track the movement of limit orders across all major exchanges simultaneously. You can find all significant zones of interest for major players across all exchanges in just a few seconds. The order books are integrated with the cluster chart for maximum analysis convenience. The "Spot" column will show the total sum of limit orders placed in the order books of spot exchanges. "Der." - the total sum of order books from derivative exchanges. Quick navigation through history is available. The large orders panel will display all significant market trades, filtering out minor orders.

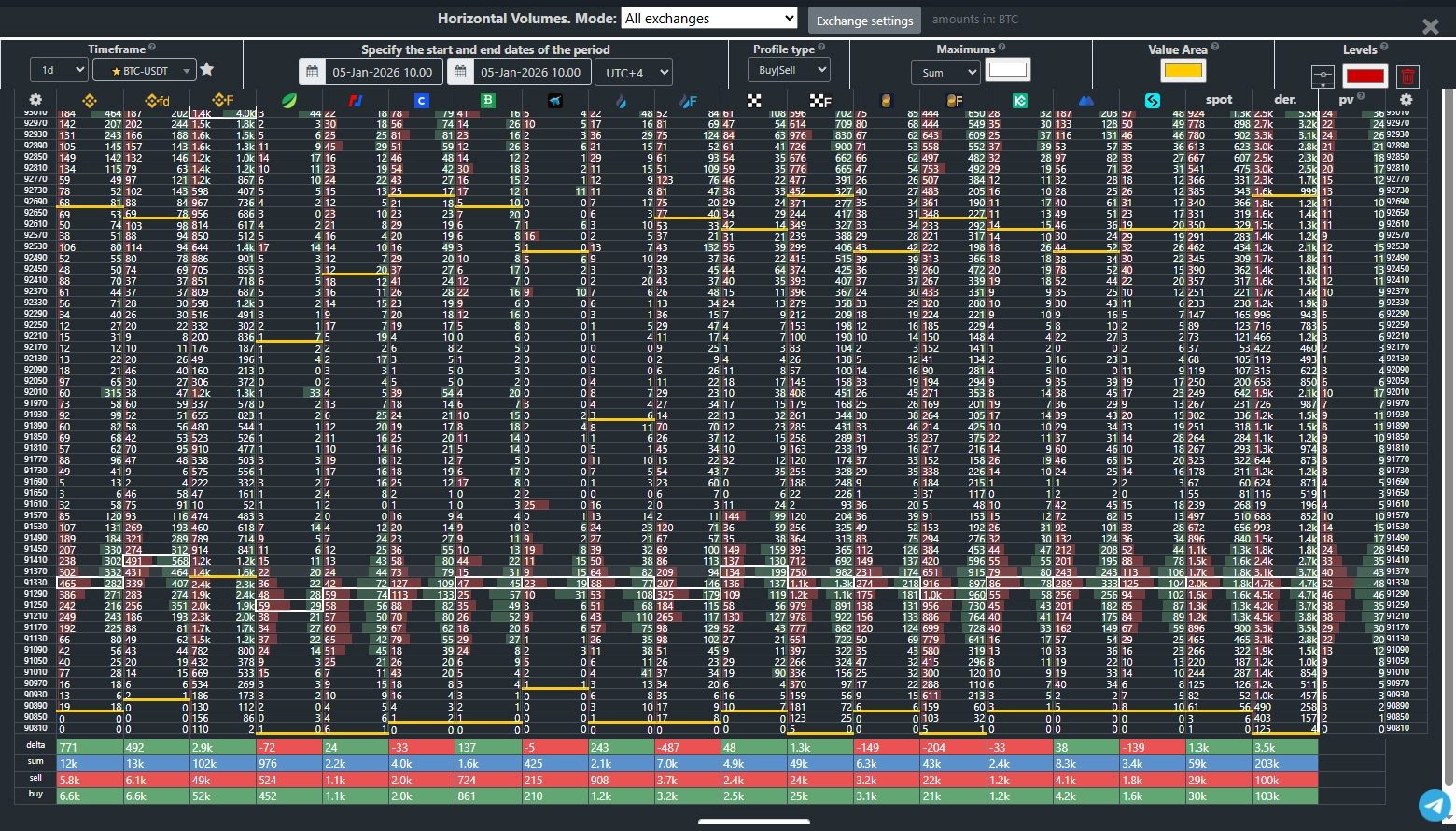

Bitcoin horizontal volumes across all exchanges

Analyze the volume profile of Bitcoin, Ethereum, and other cryptocurrencies across all major exchanges on a single screen. The volume profiles are displayed side by side, making it easy to identify zones of interest by comparing volume metrics on the most liquid platforms. Total spot market volumes.

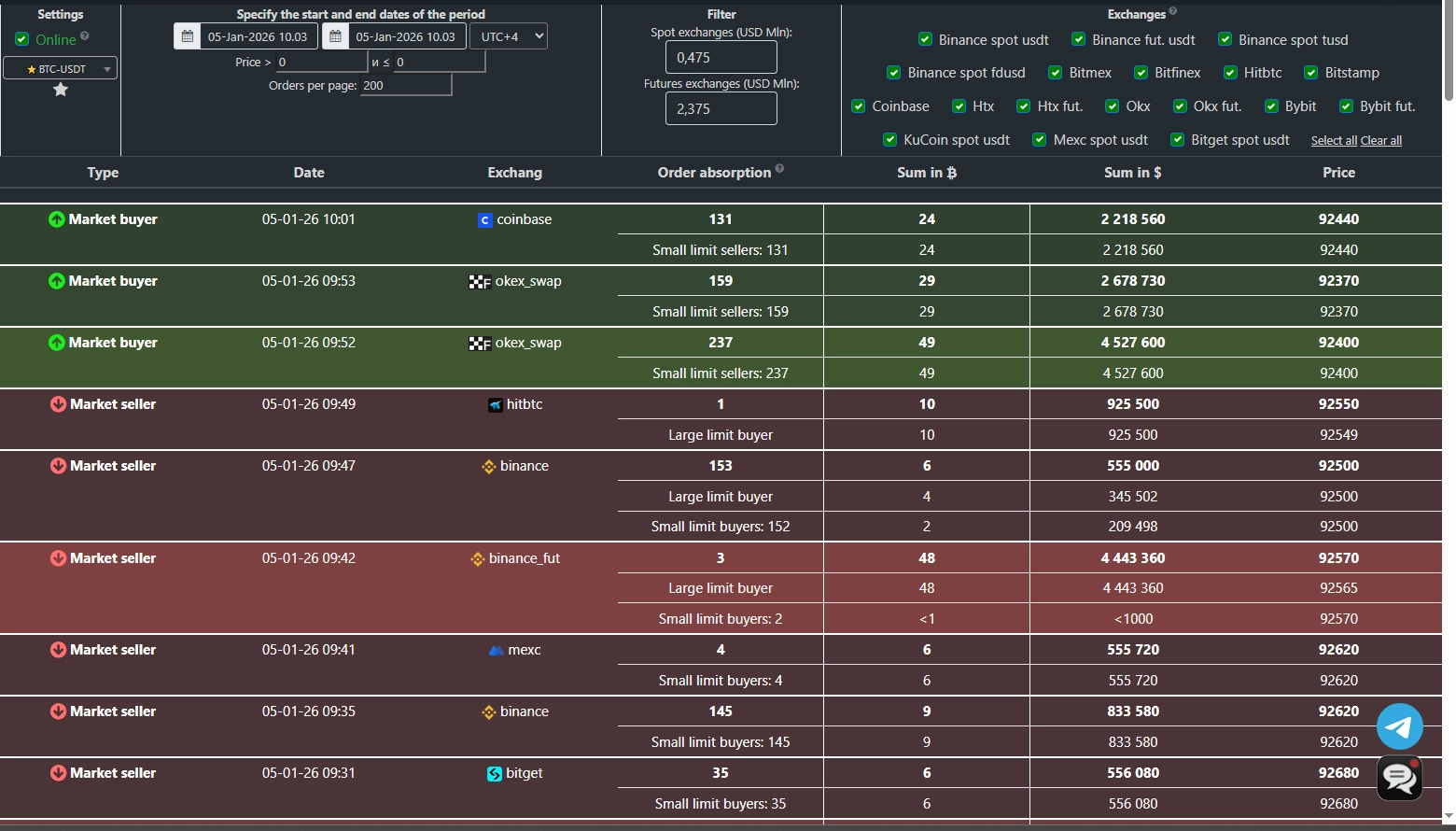

Bitcoin market orders

Track the tape of large market orders in real-time, view history by dates, and pull up a list of orders for a specific candle directly from the chart. The search function allows you to find both market and limit orders from major players, providing a complete understanding of their trading activity.

Want to learn more?

Key features in 1.5 minutes

Explore the key points.

Complete guide in 18 minutes

Get comprehensive information.

Our advantages

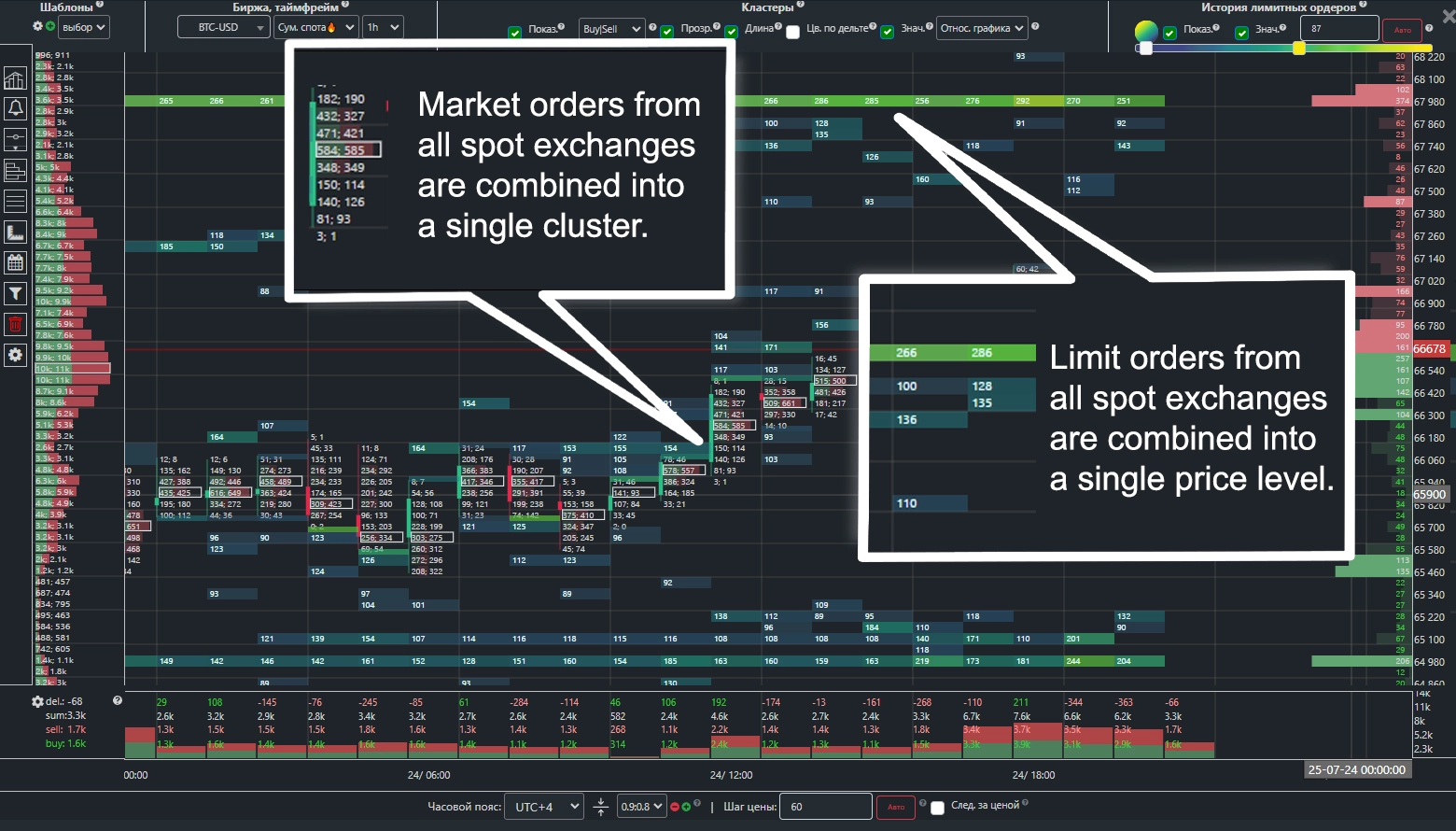

Aggregated spot chart

A unique opportunity to combine data from the largest spot exchanges into a single cluster chart with aggregated volumes, clusters, and limit order history. Learn more

Cluster chart for major players.

Only major players from the entire spot market on a shared cluster chart. You can build a volume profile and calculate various indicators, such as volumes, delta, and cumulative delta for major players across all spot exchanges.

Online access.

No software installation required. All features are available directly on the website from any device. Whether you are using MacOS, Windows, Android, or Linux – all you need is a browser and an internet connection.

7 days

1 Month

12.95

- Basic plan

- Save 0 $

- All features available.

3 Months -17%

38.85

32.26

- Only 10.75 $ / month

- Save 6.61 $

- All features available.

1 Year -34%

155.4

102.60

- Only 8.55 $ / month

- Save 52.85 $

- All features available.

*Prices in US dollars are for reference only and are calculated based on the current Central Bank of Russia exchange rate. The actual price in rubles is fixed and specified in the User Agreement.